Digital payments are expected to hit $14.78 trillion worldwide by 2027.

In a market of this size, it’s no surprise that there are countless competitors offering to act as the connection between buyers and sellers.

Choosing the best of these to integrate into your e-store is no easy task.

That’s why we’ve compiled seven of the best online payment solutions providers, analyzing their unique services and defining which businesses they suit best.

But first, we’ll review how online payment solutions work.

What Are Online Payment Solutions?

Online payment solutions are the tools and technologies that enable customers to pay for products and services online.

They oversee the entire payment process, from payment method selection to the transfer of funds to the seller’s account.

There are two core aspects of online payment solutions:

- Payment gateways: A virtual point-of-sale that authorizes payments securely.

- Payment processors: A behind-the-scenes communication technology used to transfer funds between the buyer’s and seller’s accounts securely and efficiently.

How Do Online Payment Solutions Work?

Online payment solutions work by automatically checking, facilitating and finalizing payments between a buyer and a seller.

This is done in two broad stages: card authorization and transaction settlement.

- Card authorization: The communication between a customer’s payment method and a payment gateway to enable verification and check available funds.

- Transaction settlement: The communication of transaction approval between a buyer and seller’s accounts, mediated by a payment processor.

Within the wider payment process, there are several steps that every online purchase follows:

- Selection: A customer chooses products or services on an online store.

- Checkout: The customer proceeds to a checkout page to finalize their purchase.

- Payment information: The customer puts their payment details and method of payment into a form.

- Encryption: The payment information is encrypted to ensure its security during transmission.

- Authorization: The payment gateway verifies the customer’s information and authorizes the transaction.

- Processing: The payment processor securely transfers the funds from the customer’s account to the seller’s account.

- Confirmation: The customer receives a confirmation of the successful transaction, finalizing the purchase.

7 Best Payment Gateways For Your Online Store

To help you pick the best solution for your online store, whatever your industry or size, we’ve rounded up seven of the best online payment gateways.

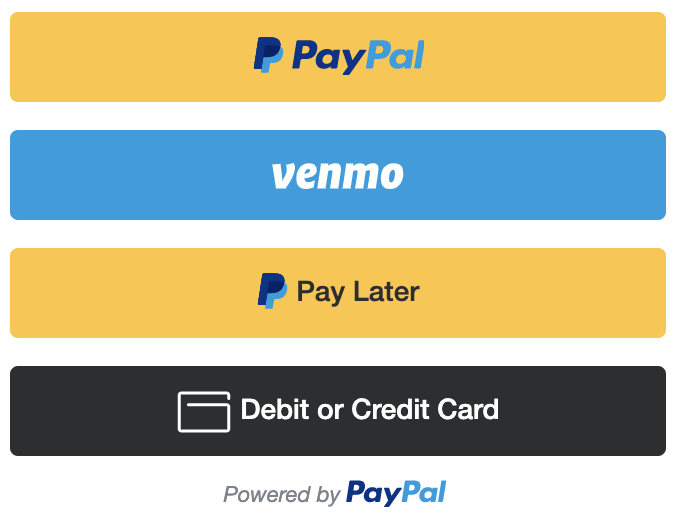

1. PayPal

Overview: PayPal for business is a global payments solutions provider that powers 430 million live accounts.

Best for: Small businesses and large enterprises

Features

- 200+ markets and 50+ currencies

- eCommerce platform integrations, such as Shopify and WooCommerce

- Billing, invoicing and taxes accounting systems

- Fraud protection and dispute automation tools

- Sales and activity reporting

Payments

- Online (cards, Venmo, Apple and Google Pay)

- In-person

- Mobile and QR codes

- Crypto

- Instalments and pay later

Costs

- Digital payments: 3.49% and $0.49 per transaction

- Online credit and debit cards: 2.59% and $0.49 per transaction

- QR codes: 2.29% and $0.09 per transaction

2. Stripe

Overview: Stripe is an online financial infrastructure provider that helps businesses accept payments, send payouts, automate financial processes, and ultimately grow revenue.

Best for: All types of eCommerce operations, from small Shopify stores to multinational corporations

Features

- Over 135 payment methods and currencies

- Pre-built payment form

- Codeless UI creation for payment gateways

- Built-in anti-fraud capacity

- Application programming interface (API) integration for marketplace and platform payments

Payments

- Online

- In-person

- Recurring (B2B)

Costs

- Standard: 2.9% and $0.30 per transaction

- Custom: Custom pricing

3. NMI

Overview: NMI is a payment gateway provider that supports over 280,000 merchants with both eCommerce payment solutions and wider full commerce capabilities.

Best for: Small eCommerce businesses

Features

- 200+ global processor connections and 125+ shopping cart integrations

- Off-site checkout pages

- Collection of APIs and software development kits (SDKs)

- PCI DSS Level 1 certified payment security

- Full suite of payment gateway features, such as management, tokenization and reporting

Payments

- Online

- Mobile

- In-person

- Self-service

Costs

- Custom pricing per payment gateway requirements received on request

4. Authorize.net

Overview: Owned by Visa, Authorize.net is an online payment solution that helps 445,000 sole traders and businesses simplify and streamline their payment processes.

Best for: Independents and small businesses

Features

- Easy-to-embed, responsive mobile forms with simple checkout buttons

- Digital customer wallets

- Payment tracking across multiple payment methods

- Advanced fraud detection technologies

- Digital invoicing

Payments

- Online

- Mobile

- Recurring

- Point of sale

- e-Check

Costs

- All-in-one: $25 monthly gateway plus 2.9% and $0.30 per transaction

- Payment gateway only: $25 monthly gateway, $0.10 per transaction plus $0.10 daily batch fee

5. Amazon Payments

Overview: Amazon Pay uses Amazon’s payment technology to give eCommerce businesses access to a well-known, proven and secure online payment solution.

Best for: Small to mid-size businesses and enterprises

Features

- Integration with top eCommerce platforms, including Magento, Shopify and WooCommerce

- Demo store that showcases the gateway in action

- Access to over 300 million Amazon customer accounts

- Customizable checkout button in seven languages

- Express payout in 24 hours

Payments

- Online web

- Mobile

- Recurring, deferred and subscription

Costs

- Domestic payments: 2.9% and $0.30 per transaction

- Cross-border payments: 3.9% and $0.30 per transaction

6. Square

Overview: Square is a provider of omnichannel commerce tools, including online payment processing.

Best for: Online stores of all sizes, with a focus on restaurants and retail.

Features

- Full website design templates and free website launch

- Payment link generation

- eCommerce platform integrations, such as Magento and WooCommerce

- Machine learning anti-fraud support

- Web design and development agency directory

Payments

- Online

- In-person

- Manually entered

- Invoices

Costs

- Free: $0 a month plus 2.9% and $0.30 per online transaction

- Plus: $29 a month plus 2.9% and $0.30 per online transaction

- Premium: Custom pricing plus 2.9% and $0.30 per online transaction

7. Adyen

Overview: Adyen is an all-in-one Dutch payments giant that processed over $825 billion worth of transactions in 2022, working with major brands like Facebook, Microsoft and eBay.

Best for: Retailers, digital businesses, transport companies, platforms and marketplaces of all sizes

Features

- In-browser, mobile app and link generation payment gateways

- Multi-payment options, such as Visa, PayPal and American Express

- Smart security authentication

- Four payment integration possibilities; drop-in, components, API and plugins

- Language and payment option localization

Payments

- eCommerce

- Mobile

- Point-of-sale

Costs

- $0.13 processing fee plus payment method fee

What To Look For When Choosing Online Payment Systems

Choosing the right online payment system for your e-store is a decision that revolves around your target audience.

From managing security concerns to offering the payment methods that your customers use most, your online payment system should build trust and encourage your audience to follow through with their purchases.

Keeping this in mind, here are five core aspects to consider:

1. Security

Your customers’ payment security is the most important factor when selecting your online payment solution.

According to IBM, 83% of organizations faced at least one data breach in 2022.

If your customers can’t trust your payment gateways you will lose out on short-term sales and damage your long-term brand loyalty — making security vital for both your customers and your business.

Ensure you understand your online payment solution provider’s security protocols to keep your visitors’ information secure.

For example, some solutions will redirect customers to third-party gateways while others will keep them on-site for payment processing.

If you’re confident in your website’s security strength and want to keep customers on-site for a smooth checkout process, choose the latter. Meanwhile, the former is a better option for smaller online stores whose security capacity is weaker than specialist providers.

2. Usability

The usability of your checkout and online payment process is a key driver in completing sales.

In fact, according to Baymard Institute, 18% of cart abandonments are a direct result of a complicated or longwinded payment process.

By choosing a user-centric online payment solution with a user-friendly interface, multiple payment options and a painless payment process, you can reduce checkout frictions and drive completed conversions.

3. Costs

Online payment solutions have varying fees, such as transaction or membership costs, which can be internalized or passed onto the consumer.

While passing the fee onto the consumer may be tempting, Baymard Institute’s research also found that 47% of cart abandonments are attributed to extra costs.

In turn, consider the transaction and payment gateway subscription fees before signing up for a tool that eats away at your profit margins or total sales.

4. Localization

Whether geo-targeting a specific location or enabling international sales, your online store can target growth through localization.

In fact, the value of cross-border eCommerce is set to exceed $3.4 trillion by 2028, up from $1.6 trillion in 2023.

Adding multiple currencies to your online payment solution can help your business tap into this opportunity of global eCommerce.

5. Compatibility

For an online payment solution to fit your eCommerce business, it must integrate with both your online platform and your customers’ preferred payment methods.

69% of online payments are made via wallets in Asia-Pacific compared to just 32% in the United States, highlighting just one of the differences in consumer preferences based on location.

By addressing these differences, you can choose an online payment solutions provider that integrates with the gateways your consumers prefer — boosting sales and limiting cart abandonments.

Build Your eCommerce Store With Digital Silk

At Digital Silk, we build e-stores that drive revenue.

Our expert team of digital strategists, web designers and developers create custom solutions optimized for conversions by researching your brand’s market, competitors and target audience before crafting seamless, user-friendly checkout and payment processes.

As a full-service web design agency, our services are platform agnostic, meaning we deliver:

- eCommerce design and development

- Shopify web design and development

- Magento web design and development

- WooCommerce web design and development

Throughout every project and partnership, we ensure:

- Project ownership

- 100% transparency

- Measurable results

- Expert guidance

Contact our team or call us at (800) 206-9413 to request your free consultation and take the next steps toward building your custom e-store today. Or, fill in the request a quote form below for a free, custom quote.

"*" indicates required fields