With the recent rise in eCommerce stores comes an increase in eCommerce challenges, including security issues that pose a threat to both consumers and eStore owners alike.

Magento payment gateway integration allows you to securely accept credit and debit card payments in your Magento store and ensure customer data is protected.

In this article, we’ll explore the top Magento payment gateways, along with the pros and cons of each. Plus, we’ll give you a sneak peek into our Magento 2 integration process at Digital Silk.

Digital Silk builds custom Magento websites. Request a quote

What Is A Payment Gateway?

A payment gateway is a merchant service that allows your customers to pay with debit and credit cards in your eCommerce store’s existing software.

Payment gateways for Magento provide a secure connection between your Magento eStore and your customer’s issuing bank.

With a Magento payment gateway, your customers can rest assured that their sensitive data is safe when they purchase items from your eStore.

How Do Magento Payment Gateways Work?

Once your customer reaches the payment stage in the checkout process, they provide their credit or debit card data, along with other personal information such as their name and address.

Your Magento payment gateway will automatically receive the transaction information and encode payment details.

The submitted data provided by your customer will then be presented to their issuing bank, which will either accept or decline the transaction.

Once the payment is authorized, the money is sent to your payment gateway by your customer’s issuing bank.

Your Magento payment gateway will then deposit your customer’s money into your company’s bank account, completing the transaction.

Types Of Payment Gateways

There are three types of payment gateways: redirects, on-site payments and off-site payments. Let’s take a look at each.

1. Redirects

Redirect payment gateways take your customer to a payment page to complete the purchase transaction.

Let’s look at PayPal as an example.

Say your customer is about to make a purchase from your eStore and PayPal is an available payment option.

When your customer clicks on the PayPal icon, it will transfer them to PayPal’s payment page.

Think of redirects as a second step for your customer to complete their payment transaction or as an opportunity for them to change their mind if they want to switch to another payment gateway.

Pros:

- You can use major payment gateways that are credible and secure

- You can rely on your payment gateway to provide your customer with security protocols and privacy liabilities

Cons:

- Your customers will receive messages from your payment gateway about their order, instead of from your brand, so you need to reach out separately for communication that derives directly from your brand

2. On-Site Payments

On-site payments offer a more effortless approach for your customers since they don’t have to leave your site to complete their transactions.

This type of payment gateway allows you to have full control over the checkout process.

Pros:

- You control your customer’s checkout experience

- You can communicate with your customers personally about their purchase

Cons:

- Unlike redirects and off-site payments, you need a merchant account, PCI compliance and SSL certificate on top of your payment gateway integration, since you’re directly accepting credit card payments

3. Off-Site Payments

Off-site payments enable your customers to checkout on your site, but they will complete the payment in another payment gateway.

This is how Stripe works, for example.

Pros:

- Just like redirects, payment gateways will do all the work for you, including holding liability for customer security and privacy

Cons:

- Also like redirects, your customers will receive messages directly from your payment gateway, so you have to set up additional communication if you want to reach your consumers directly through your brand

Top Security Features To Consider When Choosing A Payment Gateway

Here are five security methods payment gateways use to protect your customers’ data:

- Data encryption: Payment gateways use data encryption to secure payments. This minimizes the risk of unauthorized parties gaining access to customer data.

- Secure Socket Layer (SSL): Payment gateways use SSL primarily for two things: to protect your customers’ personal information and to ensure that data transfer between different parties is secure.

- PCI DSS Compliance: Payment gateways comply with the Payment Card Industry Data Security Standard, which ensures that businesses that process, store and transmit credit card data maintain a secure environment for their customers.

- Secure Electronic Transaction (SET): This protocol prevents you from accessing your customers’ sensitive card details by blocking their debit or credit card details.

- Tokenization: Tokenization reduces payment fraud and prevents hacking by generating a string of random characters (a token) from sensitive data, such as a credit card number or account number. Since you don’t have access to your customers’ card data, this also protects you from security breaches.

5 Magento Payment Gateways

From PayPal to Amazon Pay, here are five of the top payment gateways you can integrate with your Magento 2 eStore.

1. PayPal

According to a recent survey, 85% of respondents from the U.S. used PayPal in 2021, making it the most popular payment gateway.

What exactly makes PayPal so popular?

Right off the bat, PayPal is convenient to use. It doesn’t matter what kind of device you’re using. You can access your account anytime, anywhere.

PayPal rates are 2.9% + $0.30 (authorization fee) for every transaction.

Pros:

- It’s easy to use and easy to set up

- A personal PayPal account can get verified instantly

- It accepts international payments and is available in 200 countries

- It’s secure and asks for confirmation when your customer receives the product

- Anyone can create and submit personalized invoices through PayPal

- It doesn’t require monthly fees or contracts

Cons:

- It is a popular target among scammers and fraudulent sellers

- Disputes can delay refunds

- Customer service reviews are poor

- PayPal can freeze your account without contacting you, if you experience an increase in transaction volume or if you receive disputes from customers

- High commission rates

- It uses an exchange rate for transactions that require currency conversions

- Transaction fees add up if you experience an increased monthly sales volume

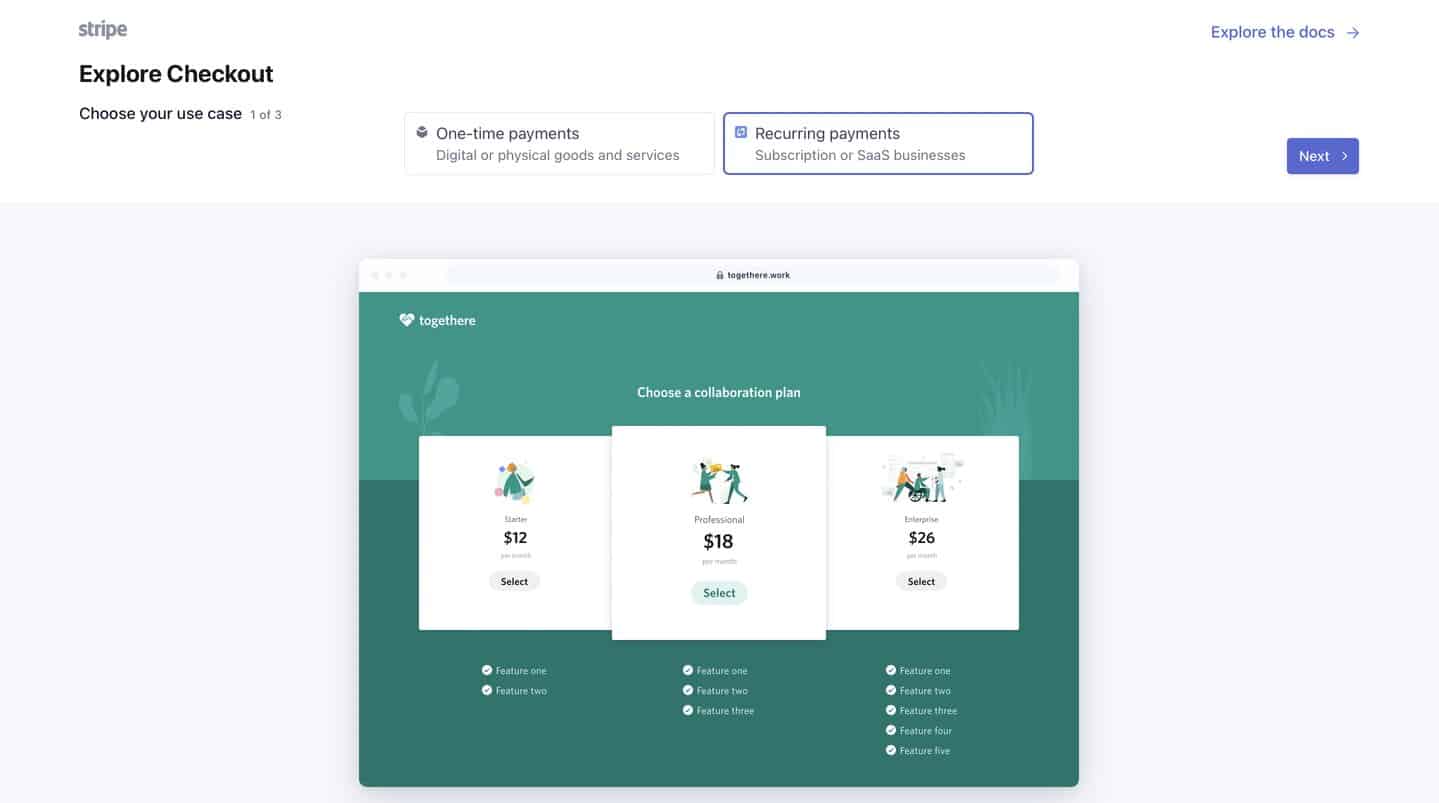

2. Stripe

Next on our list is Stripe, another payment gateway giant that was launched in 2010.

Just like PayPal, Stripe accepts international payments and provides payment services in over 100 countries.

Stripe rates are 2.9% + $0.30 (authorization fee) per transaction.

Pros:

- It’s easy to use

- During payment, Stripe stays on-site and doesn’t redirect to another website

- No extra or hidden fees

- Offers a seamless checkout experience

- 24/7 customer support via phone, live chat and email

Cons:

- If you aren’t an expert in software development, Stripe’s tools and open API may be difficult to use

3. Braintree

Braintree is a PayPal subsidiary.

Just like the other payment gateways, Braintree protects your customers from fraud protection and offers local payment proficiency and multiple outlines in one integration.

Braintree features over 130 currencies and accepts international payments in 44 countries.

There is a flat-rate fee of 2.9% + $0.30 (authorization fee) per transaction.

Pros:

- It’s secure and easy to navigate

- You only pay for what you use

- It supports global payment methods including China UnionPay and 3D Secure

- Customer service is responsive

- No monthly fees

- Available flat rate and interchange plus pricing options

- Optimized acceptance rates

- Ready-made UI to create a secure checkout for your website or app

Cons:

- It doesn’t return fees on partial refunds

4. Authorize.net

Launched in 1996, Authorize.net has over 440,000 active merchants.

From startups to enterprise-sized businesses, any brand can use this payment gateway.

Authorize.net charges a gateway fee of $25 per month plus a fee of 2.9% + $0.30 (authorization fee) for every transaction.

Pros:

- It offers flexible automated payment options, including installment and monthly recurring payments

- It stores customer information securely

- Customer service is reliable

- It is equipped with an invoicing feature that allows you to send invoices with an email address

Cons:

- The mobile app is not optimized

- In addition to the payment gateway, you need to create a merchant account

5. Amazon Pay

Launched in 2007, Amazon Pay has a large following thanks to Amazon’s consumer base. It primarily focuses on giving users the option to pay with their Amazon accounts.

According to a 2018 survey, Amazon ranked third as the most valuable brand gaining consumer trust.

Pros:

- Quick and easy setup

- Optimized checkout process

- Provides a mobile-friendly user experience

Cons:

- It doesn’t support PayPal payments

- Your customers will need an Amazon account to make a payment

- Just like PayPal, Amazon can freeze your account if you don’t follow their rules

Let’s discuss your project! Schedule A Consultation

Features To Consider When Choosing A Magento Payment Gateway

We’ve laid out the pros and cons for you, but if you’re still not sure which gateway (or gateways) to integrate with your eStore, here are the top four features you’ll want to keep in mind.

1. Security

Security should be a top priority when it comes to your payment gateway.

Does it support data encryption? Is it a PCI Service Provider Level 1?

To help keep customer data safe and avoid damage to your brand reputation thanks to a security breach, make sure your payment gateway is secure.

2. Pricing

As noted above, different payment gateways have different pricing structures.

Pricing depends on several factors, including the payment types you accept, your total revenue and your business model.

3. Recurring Billing

If you offer a subscription service, you’ll want to choose a payment gateway that includes a recurring billing feature.

It will automatically charge your customers within the time frame you set, and allow you to manage failed credit card payments with a retrieval feature, like Stripe offers.

4. Customer Support

Research shows that 92% of customers are more likely to make a repeat purchase from your business after experiencing positive customer service.

Your payment gateway should offer 24/7 customer support to prevent delays in response and solution times when an error occurs.

Check community boards, online forums and app reviews to find a payment gateway that offers around-the-clock customer services.

When it comes to payment gateways, you don’t need to limit yourself to just one.

Stacking your payment gateways gives your customers more payment options to choose from, and also give your brand a bigger reach (think international transactions).

Magento 2 Integration Services At Digital Silk

At Digital Silk, our certified Magento experts also work as consultants for your project, from beginning to end.

Here’s an inside look at our Magento 2 integration process:

- Onboarding: This is where we get to know you and your brand. First, we’ll conduct extensive research on your industry, target audience, competition and user behavior. Next, we’ll analyze the solution you’re using and your existing Magento architecture.

- Recommendations: After understanding your goals and conducting our research, we will recommend third-party solutions that can help you reach your objectives.

- Integration: Next is the integration stage. We will harmonize your ERP, POS, PIM, marketing and accounting systems to improve inventory management, productivity and centralize your data flow through real-time analytics. This is also where we’ll integrate your payment gateways.

- Security: Our team will meticulously monitor Magento’s latest security updates to keep your solution secure while ensuring your customer data is safe.

- Functional QA: We test your integrations in the staging environment (sandbox) and conduct tests in your production environment. This ensures that everything is up and running as it should be.

- Launch: Once we complete quality assurance, your eStore is ready for launch.

- Support And Maintenance: After each successful launch, we offer additional maintenance and support services to ensure your eStore is flexible, secure and up-to-date with the latest industry and technology trends.

Additional Magento 2 Services At Digital Silk

Our team of Magento experts offers more than integration. When you need support for your Magento project, you can count on our top experts to deliver the following solutions:

1. Magento End-to-End Development Services

Your brand-new Magento eStore will be equipped with up-to-date functionalities that create a seamless shopping experience, including flexibility, high speed, security and more.

Our Magento experts create custom shopping experiences centered on your target audience to increase engagement, reach new customers and encourage repeat visits.

2. Custom Magento Development

We create personalized solutions to provide your Magento eStore with a customized CMS, clean code, superior functionality and scalability, to help your brand stand out against the competition.

3. Magento Website Design

At Digital Silk, we constantly strive to create the best strategic designs by observing industry trends, target audience behavior and competitors’ digital presence, and applying research-driven best practices to your customized solution.

4. Magento PWA

Your Magento eStore should provide your customers with an unforgettable shopping experience and a seamless checkout process, whether online or offline. Our experts provide Magento PWA to help ensure an engaging experience and encourage customers to return.

5. Magento Consulting

We offer Magento consulting services as part of our complete development offering or as a stand-alone service.

Our Magento professionals perform extensive research into your industry and competitors to propose strategies to optimize conversion, site visits, visibility and brand reputation.

6. Magento Migration Services

Out with the old Magento and in with the new.

Once you migrate your eStore from Magento 1 to Magento 2, you can enjoy updated functionalities and features. Including improved security, speed, flexibility and engagement, which ultimately leads to an optimized shopping experience and greater revenue.

Wrapping Up On Magento 2 Payment Gateway Integration

Integrating a payment gateway to your Magento eStore can help increase security, provide more payment options for your customers and streamline the purchasing process.

Top payment gateway options for Magento 2 include PayPal, Stripe, Braintree, Authorize.net and Amazon Pay. Stacking payment gateways can give your customers more options and improve their experience with your brand.

"*" indicates required fields